Exposure to even a small amount of water can quickly result in damage to your franchise’s property. For insurers, water damage is one of the most common types of property claims, initiating somewhere between 15% and 50% of commercial property loss claims and resulting in bills from $10,000 to more than $1 million, depending on the industry.

Winter and spring months are particularly hard on your commercial property. From plumbing and system failures to water intrusion events, now is a good time to review your risks and make sure your business is prepared to deal with how water damage impacts franchise property.

Franchise Water Damage Risks

There are a number of ways excess water can impact your franchise. The vast majority of incidents relate to failures with internal building systems, namely plumbing, HVAC systems and appliances.

- Plumbing – Pipes and fittings don’t last forever. These components will eventually fail in every building. Over time, small continuous leaks can cause almost as much damage as pipes that burst suddenly from freezing and thawing cycles.

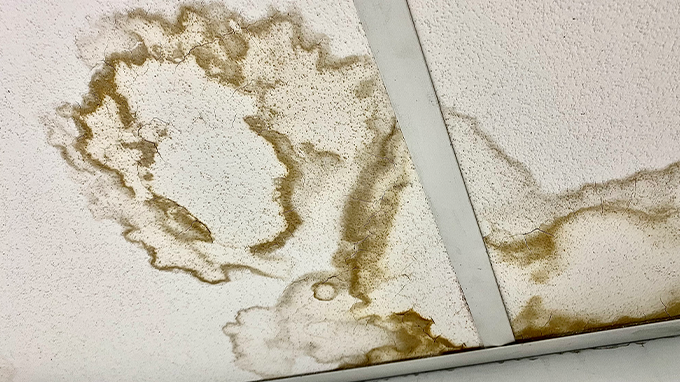

- HVAC systems – HVAC system lifespans can deteriorate with irregular or improper maintenance and challenging operating conditions. Clogged drains, frozen coils and line issues can frequently result in water damage.

- Appliances – Appliances such as water heaters, ice makers, dishwashers and air conditioners can leak and cause property damage in commercial spaces. Even appliances in a neighboring space could result in damage to your franchise.

Water intrusion from exterior sources can also be a source of damage for franchise owners. There are various hazards to look out for, particularly snowmelt, ice dams and roof collapse.

- Snowmelt – Snowmelt in the spring can lead to excess runoff and even flash flooding, if precipitation from multiple storms melts all at once. If snow is piled high around buildings, it could also affect the foundation or basement.

- Ice dams – Ice dams occur when winter precipitation melts and refreezes on rooftops preventing proper draining. The water can make its way under shingles and into seals, causing damage to a building’s structural components.

- Roof collapse – Roof collapse is possible if too much snow, sleet, ice or even rain accumulates on a roof. The excess weight can damage roofing materials and additional water can make its way inside doing more damage to your building.

Water Damage’s Impact on Your Franchise

Water damage can have a big impact on your franchise business. Yet besides the need to clean up, dry and repair the damage, there are additional aspects of recovery few think about. If your business experiences a moderate water intrusion event, you may find that you need to:

- Clean up the affected area, including moving out ruined supplies, product inventory or equipment.

- Rebuild parts of your building, from walls, floors and ceilings to plumbing and electrical and more.

- Reallocate existing space or secure space at a different location to continue to operate your business.

- Contact your clients and customers, vendors and more to communicate delays and changes.

- Take ownership over any delays providing products and services and try to get things back on track.

- File your insurance claim, including gathering and submitting documentation of damages and expenses.

- Pay for immediate, upfront costs out of pocket, such as site cleanup, moving and storage expenses.

- Absorb the costs of incident expenses that fall outside the scope of your insurance coverages.

The impact of excess water is different for every incident. Some are as easy as cleaning up a puddle on the floor, while others can be far more involved. Yet no matter the specifics, you can expect any leak problem to take focus and time away from running your business — and potentially cost your business thousands of dollars, as well.

Managing Your Risk of Water Damage

While excess water presents a serious threat to your franchise business, there’s a lot you can do to minimize the risk. The first steps can be fairly simple. For technical solutions, many businesses turn to moisture alarms that activate when excess moisture is detected in a particular area or leak detection systems that automatically shut off the water supply when a major leak is detected. Another easy fix is to upgrade standard rubber appliance hoses to more durable braided steel options.

Education also plays a key role in minimizing water damage risk. If you and your employees know what problem signs to look for and what actions to take in an emergency, the damage from excess water can be greatly reduced.

- Noticing unexplained puddles or standing water, dripping or running water sounds, mold and mildew growth or increased water bills are reasons to investigate further.

- Knowing the location of your main water supply and how to turn it off, how to disconnect appliances and how to quickly clean up excess water will minimize the damage.

Insurance also plays a vital role in protecting franchises from the costs of water damage incidents. Make sure to review your current policies and the coverages they include. Contact your insurance representative to ask questions if needed. If your current policy lacks the type and amount of coverage needed to protect your business from a serious incident, consider purchasing more coverage for better risk management.

Insurance coverage from Lockton Affinity can help you protect your business from the high cost of water damage including damage to your property and buildings and interruption to your business operations. Determining the specific coverages you need can be tricky, which is why we offer expert advice that’s just a phone call away. Our dedicated representatives can help you evaluate your water damage exposures and find coverage that protects against your unique risks. Contact Lockton Affinity today at (844) 456-0660 to get started.

Recent Comments